Ally Invest: Best for

- Low trading commissions

- Ally Bank customers

- Sign-on promotions

Partner Contribute considers every contingency to say the least, and will probably be a particularly fantastic fit for existing Partner clients who are searching for an able intermediary. Obviously, Partner offers the business standard stock and ETF commission of $0, yet it likewise has the best-undiscounted commission for choices, aside from just the sans commission dealers.

Telephone support 24 hours every day, seven days seven days can assist you with getting your inquiries responded to rapidly, and the easy to use versatile application assists you with making your exchanges as well as lead all your other Partner business.

Ally Invest: In the details

Least Equilibrium

$0

Cost per stock exchange

$0

Cost per choices exchange

$0.50 per contract

Advancement

–

Without commission ETFs

All ETFs

No-exchange charge common assets

More than 17,000

Protections tradable

Stocks, ETFs, securities, common assets, choices, forex

Client support

Telephone day in and day out, visit, email

Account charges

$50 exchange charge, $50 IRA move expense, $25 IRA shutting expense

Portable application

Partner offers the “Partner Portable” application on the Apple Application Store and Google Play Store.

Pros: Where Ally Invest stands out

Low trading costs

Choices dealers will be particularly satisfied with Partner’s contribution. Its generally expected bonus structure is $0.50 per contract, among the best-undiscounted costs for exchanges the business, where the standard is typically $0.65 per contract. In the event that you need modest choices exchanges without exchanging volume to accomplish a rebate, Partner is an extraordinary decision. Today, less expensive spots incorporate Robinhood and Webull, which offer a no-commission structure for all items.

Partner charges $0 for stock and ETF exchanges, placing it in accordance with other major web-based agents. In the mean time, commissions on bond exchanges are $1 per bond, with a $10 least for every exchange.

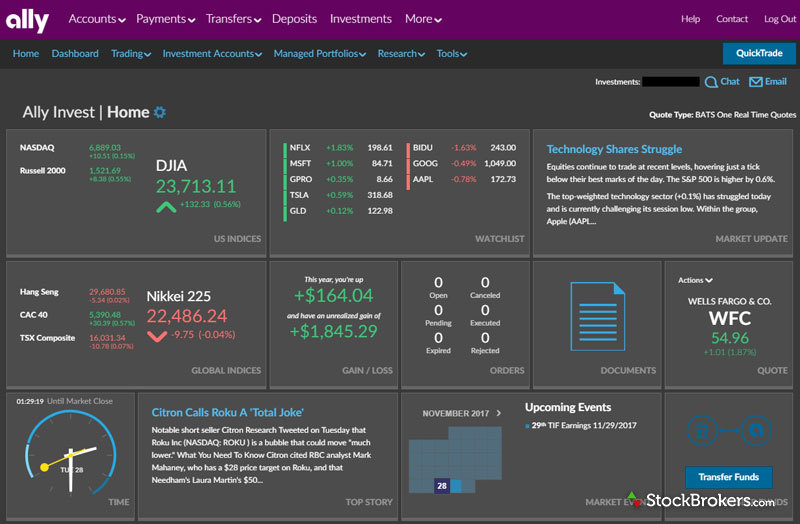

Integration with Ally

Partner Contribute’s mix is a reward for current Partner clients, permitting them to unite their monetary records inside one foundation, as you can find in the portable application. That can be perfect for moves between accounts, lessening postpones on cash moves between a bank and representative, for instance. It very well may be helpful to just have your records in a single spot when expense time shows up. Frequently, Partner Contribute winds up feeling like simply one more tab on the dashboard of the whole Partner site.

Partner Contribute Robo Portfolios is one more choice for those hoping to adopt a mechanized strategy to effective money management. For simply a $100 least venture, Robo Portfolios will contribute in view of your objectives and naturally rebalance your portfolio day to day.

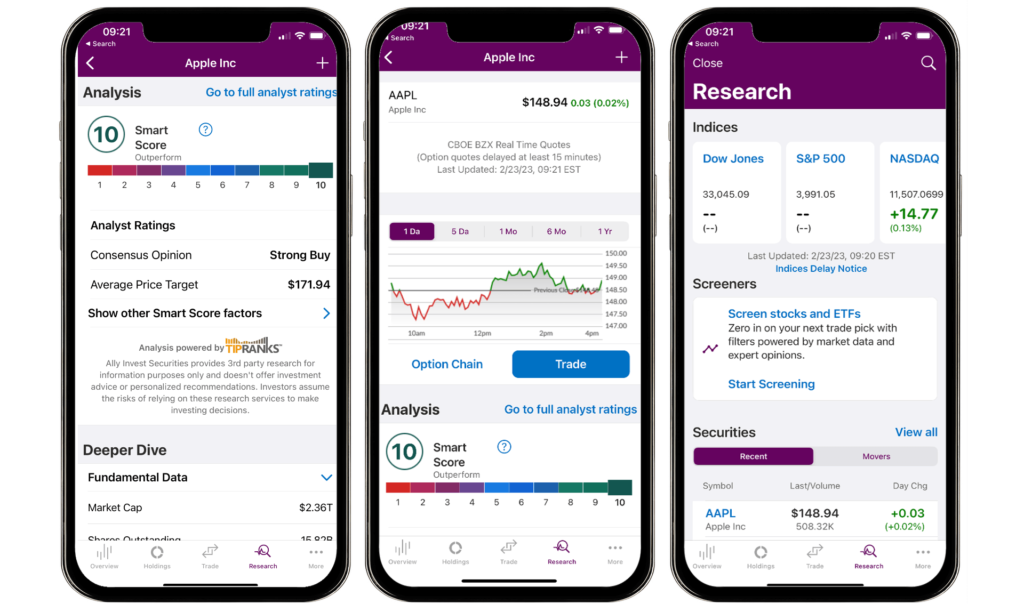

Mobile app

Dissimilar to many dealers, Partner Contribute doesn’t have a committed application for its business exercises. All things being equal, the Partner Versatile application gives usefulness to the organization’s all’s records and exercises. For instance, you can see every one of your records in a single spot – checking, reserve funds, Compact discs, charge cards and money market funds. That is an incredible component for clients who as of now have a Partner record and need to keep their monetary life united inside there.

This across the board application fits that bill well and is easy to explore and utilize. You’ll have the option to store checks, move cash between accounts, cover bills, check tax documents, access investment funds instruments, track down ATMs and play out various other financial exercises.

On the application’s financial planning side, you’ll have the option to do significantly more. You can check your portfolio with streaming statements and exchange stocks as well as multi-leg choices. Clients can perform specialized examination with graphing apparatuses and access the most recent market news. While it doesn’t have every one of the highlights of Partner’s exchanging stage, it performs well when you can’t be at your work area.

If you have any desire to exchange money, Partner likewise gives a committed application to that called Partner Forex. This application permits you to enter numerous request types, access streaming titles from Reuters and week by week reports, graph market patterns, get alarms and by and large deal with your record.

No-transaction-fee mutual funds

Partner at long last got in the game on no-exchange charge common assets in mid 2023 – and did as such with a major sprinkle. For quite a long time the dealer charged a $9.95 exchange expense for common assets when the remainder of the business – central members like Charles Schwab, Intelligent Specialists and Loyalty – offered huge number of assets without an expense. Presently Partner not just shut the distance on rivals by disposing of this expense, however it likewise offers exactly 17,000 assets without it, putting Partner close to the highest point of the load with Intelligent Dealers.

Obviously, a greater smorgasbord of decisions isn’t generally better in the event that the more modest smorgasbord has what you need. Yet, a more extensive choice method you’re bound to find what you need.

Customer support

Partner truly moves forward in this classification. The dealer offers all day, every day telephone support and a web-based talk capability to course you to a delegate rapidly. There are likewise more regular means, like email, however clients don’t have the choice of going to an actual branch for help. However, this last option point likely ought not be an issue for most financial backers.

Cons: Where Ally Invest could improve

Account fees

The record charges are to some degree astonishing here since they’re abnormal at most specialists today. Partner actually charges a $25 expense for ending an IRA. On the off chance that you move the record, that is an extra $50, while a fractional record move will likewise run you $50.

On any standard record, you’ll likewise be charged a $50 expense for a full or halfway exchange.

No fractional shares on purchases

Partner does a ton of things well from a client the board stance, so unfortunately it doesn’t offer clients the capacity to exchange fragmentary offers. You will not have the option to get them straightforwardly, yet you will actually want to reinvest your profits into partial offers.

Assuming partial offers are basic to you, Robinhood and Devotion Speculations permit you to buy and reinvest in fragmentary offers in a large number of stocks.