Advancement vs Wealthfront: these are the two biggest and most popular autonomous suppliers in the robo-guide space.

They’re additionally two of the earliest sections to the field. Thus, they’ve advanced to where they have definitely a bigger number of administrations than what is presented by the ordinary robo-counselor.

Advancement vs Wealthfront: these are the two biggest and most popular autonomous suppliers in the robo-counselor space.

They’re additionally two of the earliest sections to the field. Hence, they’ve developed to where they have undeniably a bigger number of administrations than what is presented by the ordinary robo-counsel.

So we should do a drill down to decide precisely very thing each help offers, including key similitudes and contrasts.

Advancement vs Wealthfront-The Essentials

Both Improvement and Wealthfront work totally on the web and have you complete a poll when you apply for a record. The reason for the survey is to decide your financial backer profile.

That is included your venture objectives, your time skyline, and your gamble resilience.

Building Your Portfolio

When your profile still up in the air, they fabricate a portfolio for you consolidating those variables.

The portfolio is fabricated in view of Current Portfolio Hypothesis (MPT), a methodology that boosts returns while limiting dangers using legitimate resource distribution. Your portfolio is overseen by PC calculations that are planned principally to follow the developments of the general business sectors.

Keeping Costs Low

Both Improvement and Wealthfront charge an incredibly low yearly warning expense to make and deal with your portfolio.

Truth be told, the expense is just a negligible portion of what you would pay for a conventional human monetary counsel while conveying a lot of a similar help. They’re ready to work with a low expense structure since they’re completely on the web, have no land, and have generally couple of representatives.

Your portfolio is contained resource distributions put resources into trade exchanged reserves (ETFs). Since they are file reserves intended to match the basic business sectors, they have extremely low cost proportions.

Using a little modest bunch of ETFs, every stage can put resources into in a real sense great many individual protections for an exceptionally minimal price. Each robo will then, at that point, deal with your portfolio on a continuous premise, which will incorporate intermittent rebalancing to keep up with target resource distributions, as well as reinvestment of profits.

The huge benefit of either robo-consultant is you should simply support your record the mechanics of overseeing it are taken care of totally by the assistance.

Here are the fundamental highlights of the two administrations:

| Features | Betterment | Wealthfront |

|---|---|---|

| Initial Investment | $0 | $500 |

| Available Accounts | Individual and joint taxable accounts; traditional, Roth, SEP and rollover IRAs; trusts | Individual and joint taxable accounts; traditional, Roth, SEP and rollover IRAs; trusts and 529 plans |

| Tax-loss Harvesting | Yes | Yes. Wealthfront offers an advanced service with stock-level tax-loss harvesting |

| Rebalancing | Yes | Yes |

| Dividend Reinvesting | Yes | Yes |

| Mobile App | Android & iOS devices | Android & iOS devices |

| Live Support | Yes | Yes. Wealthfront has free phone support and employs at least 13 RIAs for your support. |

Portfolio Mix

The portfolio blend of both Advancement and Wealthfront looks commonly comparable, in some measure on a superficial level. Each incorporates a predetermined number of resource classes in the two stocks and securities. Furthermore, every one of those resource classes is addressed by a solitary trade exchanged reserve (ETF).

Tax-loss harvesting

Since each robo-guide utilizes charge misfortune collecting in the administration of their portfolios, most resource classes are addressed by a few almost indistinguishable ETFs. Under charge misfortune reaping, losing positions are offered to balance capital additions in other resource classes.

This limits the capital additions charge due at whatever year. Yet, to keep up with the objective resource assignments, ETFs sold are supplanted by auxiliary ETFs, in a little more than 30 days to stay away from the IRS wash deal rules.

Betterment Portfolio Mix

Improvement’s essential portfolio applies to the two its Computerized and Premium plans. It incorporates a blend of 14 distinct resource classes-six for stocks and eight for securities and fixed pay.

Because of the way that Improvement utilizes charge misfortune gathering, each stock resource class incorporates the utilization of three comparative assets. Since charge misfortune reaping is less utilized with bonds and fixed pay resource classes, four incorporate a couple of elective ETFs, while four have no other options. Since they’re pay producing resources, charge misfortune collecting isn’t a thought.

Here are the resource classes utilized for the two stocks and bonds, as well as the ETFs utilized for each.

Stocks:

| Asset Class | Primary ETF | Secondary ETF |

|---|---|---|

| US Total Stock Market | Vanguard US Total Stock Market (VTI) | Schwab US Broad Market ETF (SCHB) |

| US Value Stocks – Large Cap | Vanguard US Large-Cap Value (VTV) | iShares S&P 500 Value ETF (IVE) |

| US Value Stocks – Mid Cap | Vanguard US Mid-Cap Value (VOE) | iShares Russell Midcap Value Index (IWS) |

| US Value Stocks – Small Cap | Vanguard US Small-Cap Value (VBR) | Russell 2000 Value (IWN) |

| International Developed Market Stocks | Vanguard FTSE Developed Markets (VEA) | Schwab International Equity ETF (SCHF) |

| International Emerging Market Stocks | Vanguard FTSE Emerging Markets (VWO) | iShares Inc/Core MSCI Emerging (IEMG) |

Bonds:

| Asset Class | Primary ETF | Secondary ETF | Secondary ETF |

|---|---|---|---|

| US High Quality Bonds | iShares Barclays Aggregate Bond Fund (AGG) | Vanguard Total Bond Market ETF (BND) | N/A |

| US Municipal Bonds | iShares National AMT-Free Muni Bond (MUB) | SPDR Nuveen Barclays Capital Muni Bond (TFI) | N/A |

| US Inflation-Protected Bonds | Vanguard Short-term Inflation Protected Securities (VTIP) | N/A | N/A |

| US High-Yield Corporate Bonds | Xtrackers USD High Yield Corporate Bond (HYLB) | SPDR Barclays Capital High Yield Bond (JNK) | iShares iBoxx $ High Yid Corp Bond (HYG) |

| US Short-term Treasury Bonds | iShares Barclays Short Treasury Bond (SHV) | N/A | N/A |

| US Short-term Investment Grade Bonds | iShares Short Maturity Bond (NEAR) | N/A | N/A |

| International Developed Market Bonds | Vanguard Total International Bond (BNDX) | N/A | N/A |

| International Emerging Market Bonds | iShares Emerging Markets Bond (EMB) | Vanguard Emerging Markets Government Bond (VWOB) | PowerShares Emerging Markets PCY Debt (PCY) |

Interesting Betterment Asset Class Feature

Notice that three of the six stock resource classes are held in US esteem stocks, for huge , mid-, and little cap stocks.

A worth stock is a security exchanging at a lower cost than what the organization’s presentation may somehow demonstrate. These stocks will more often than not beat the general market over the long haul, and putting resources into them is quite possibly of the most respected procedure on Money Road. It’s a standard component of Improvement’s venture technique.

Click here to get started with Betterment.

Wealthfront Portfolio Mix

Wealthfront puts your portfolio in nine resource classes, including five for stocks and four for bonds. Since Wealthfront likewise utilizes charge misfortune reaping, every resource class for the two stocks and securities incorporates two ETFs, to empower trading comparable assets for each class.

Stocks:

| Asset Class | Primary ETF | Secondary ETF |

|---|---|---|

| US Stocks | Vanguard CRSP US Total Market Index (VTI) | Schwab DJ Broad US Market (SCHB) |

| Foreign Stocks | Vanguard FTSE Developed All Cap ex-US Index (VEA) | Schwab FSE Dev ex-US (SCHF) |

| Emerging Markets | Vanguard FTSE Emerging Markets All Cap China A Inclusion Index (VWO) | iShares MSCI EM (IEMG) |

| Real Estate | Vanguard MSCI US REIT (VNQ) | Schwab DJ REIT (SCHH) |

| Natural Resources | State Street S&P Energy Select Sector Index (XLE) | Vanguard MSCI Energy (VDE) |

Bonds:

| Asset Class | Primary ETF | Secondary ETF |

|---|---|---|

| US Government Bonds | Vanguard Barclays Aggregate Bonds (BND) | Vanguard Barclays 5-10 Gov/Credit (BIV) |

| TIPS | Schwab Barclays Capital US TIPS (SCHP) | Vanguard Barclays Capital US TIPS 0-5 Years (VTIP) |

| Municipal Bonds | Vanguard S&P National Municipal (VTEB) | State Street Barclays Capital Municipal (TFI) |

| Dividend Stocks | Vanguard Dividend Achievers Select (VIG) | Schwab Dow Jones US Dividend 100 (SCHD) |

Intriguing Wealthfront Resource Class Elements

There are two. The first is the consideration of both land and regular assets in the stock portfolio. This gives a proportion of elective speculations, as well as more noteworthy security against expansion. The second is the consideration of profit stocks in the bond/fixed pay portfolio.

Profit stocks turn out consistent revenue as well as the potential for capital appreciation, particularly in rising financial exchanges.

Specialized Portfolios

Notwithstanding the fundamental speculation portfolios, each robo-counsel offers at least one specific portfolios.

Betterment

Advancement offers five particular portfolios, notwithstanding the essential portfolio for Computerized and Premium plans.

Socially Responsible Investing

This portfolio mirrors a 42% improvement to social obligation scores for their US huge cap possessions. It utilizes loads of organizations meeting specific social, ecological, and administration rules.

They supplant the US Stocks-Huge cap and Developing Business sector Stocks with the accompanying ETFs: iShares MSCI KLD 400 Social (DSI), iShares MSCI USA ESG Select ETF (SUSA), and iShares ESG MSCI EM ETF (ESGE).

Goldman Sachs Smart Beta

The portfolio is overseen by Goldman Sachs and endeavors to beat the regular market cap methodology. It’s an effectively overseen portfolio, implying both higher gamble and possibly higher prizes. It withdraws from ordinary robo-consultant portfolios that main endeavor to match the basic market.

If it’s not too much trouble, note that this help comes at an additional expense.

BlackRock Target Income

A portfolio that is 100 percent put resources into obligations of different yields and intended to give protection against the highs and lows of the financial exchange. Its primary object is producing pay and not capital appreciation. Pay is created by a blend of longer-term securities, and lower-quality securities that give more significant returns.

Tax-Coordinated Portfolio

Assigns speculations between available records and duty conceded accounts, to make the most potential assessment proficient portfolio. For instance, capital additions producing stock ETFs, are held in available venture accounts, where they can exploit charge misfortune reaping. Yet, pay creating security reserves are held in charge conceded accounts.

Flexible Portfolios

Essentially, this portfolio empowers you to change the singular resource class loads in the portfolio Advancement plans for you. It permits you to stray from the suggested portfolio, while as yet partaking in the advantages of their general guidance. This ability is planned exclusively for additional accomplished financial backers.

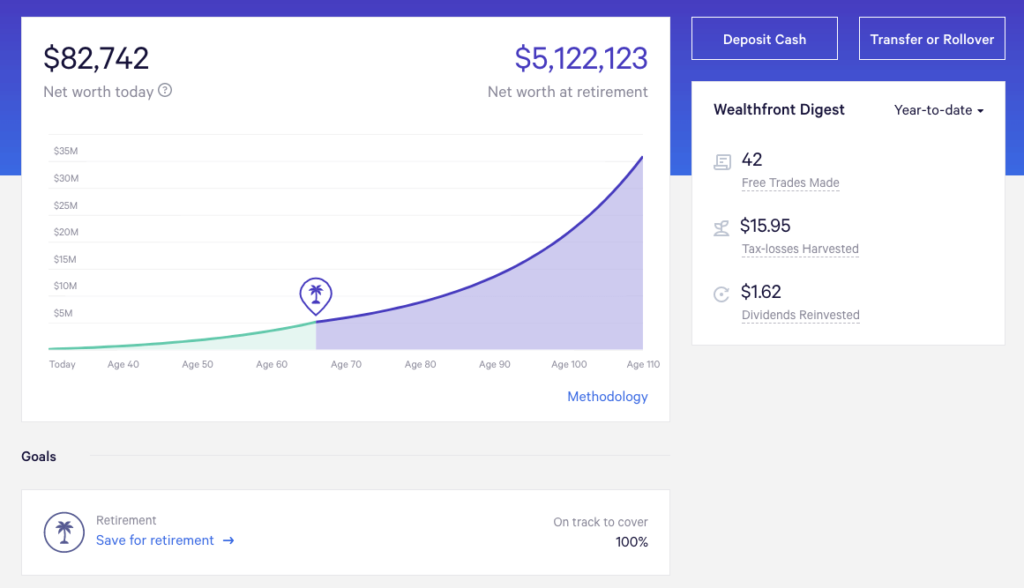

Wealthfront

Wealthfront offers their own arrangement of particular portfolios through their PassivePlus venture suite:

Stock-level Expense Misfortune Collecting

This portfolio is intended for considerably more prominent expense proficiency, including a blend of ETFs and individual stocks. The consideration of stocks expands the capacity to exploit charge misfortune collecting.

Stock-level Duty Misfortune Gathering is an improved type of Assessment Misfortune Reaping that searches for developments in individual stocks inside the US stock record to collect more expense misfortunes and lower your expense bill.

Up to 500 individual stocks will be bought from the S&P 500 file, as opposed to through a record based ETF. This is accessible for account totals more than $100,000 at no extra expense.

Wealthfront Hazard Equality

This system has shown higher long haul returns by distributing the portfolio by leveling the gamble commitments of every resource class, disregarding their normal returns. The system involves influence with specific situations in the portfolio. It’s likewise accessible for accounts more than $100,000 for an extra charge of .03%.

Risk Equality is an elective approach to dispense capital across various resource classes, similar as Present day Portfolio Hypothesis (MPT), otherwise called mean-change advancement. By and large, Chance Equality has created better returns for a given degree of portfolio risk than the more normal MPT.

Savvy Beta

This technique utilizes numerous elements to decide the weighting of stocks in a portfolio. Conventional list put together money management depends with respect to showcase capitalization, meaning the organizations with the most noteworthy market capitalization gauge the most vigorously in a portfolio. However, Brilliant Beta deemphasizes market capitalization for multifaceted models.

This help is likewise accessible at no extra expense, yet just on account surpluses more than $500,000.

Cash Records

Both Advancement and Wealthfront offer money account items that are minimal expense and accompanied financing costs that are a lot higher than the business normal.

Advancement Money Hold

Advancement Money Hold is the name that Improvement has given to its investment funds and financial records.

With an Improvement Money Save account, you’ll procure a higher-than-normal APY. What’s more, their warning expense doesn’t matter to Advancement accounts.

Advancement Really looking at accompanies totally zero expenses. That implies with no record expenses, no overdraft charges, and no base adjusts. Also, any ATM expenses are repaid around the world.

Wealthfront Money Record

This high return bank account has zero market risk, zero charges, and it acquires you 1.27% APY.

You won’t be charged any warning, withdrawal, or different expenses for the money account. Also, the venture warning charge of 0.25% doesn’t make a difference to Wealthfront’s Money Record. Like Improvement, Wealthfront can keep this record free by getting a little part of the premium brought in on the cash in your money account.

Charges and Evaluating

Advancement and Wealthfront are both unquestionably reasonable speculation decisions. This is the way they stack up on cost.

The amount Does it Cost to Utilize Advancement?

On the essential Advanced plan, the warning charge is 0.25% on surpluses up to $2 million and 0.15% on higher equilibriums.

On the Top notch plan, the charge is 0.40% on surpluses up to $2 million and 0.30% on higher equilibriums.

There are no charges on Improvement Money Hold (reserve funds) or financial records.

The amount Does it Cost to Utilize Wealthfront?

Wealthfront charges a yearly warning expense of 0.25% of your all out portfolio under administration.

There is no charge for Wealthfront Money Record or Wealthfront Free Monetary Preparation.

Safeguarding Your Speculations

While you’re thinking about any monetary establishment, it’s vital to know that you won’t lose your cash assuming they kick the bucket. You shouldn’t need to stress over that with Improvement or Wealthfront. This is the way they safeguard your resources.

Is Advancement FDIC Protected?

Advancement cash accounts are FDIC protected up to $1 million on Investment accounts and up to $250,000 on Financial records.

Advancement venture accounts, be that as it may, are not FDIC safeguarded. All things being equal, they are safeguarded by SIPC up to $500,000 of missing resources and $250,000 on cash claims. Regardless of whether Improvement became ruined, there’s a tiny opportunity that SIPC protection would have to step in. Yet, realizing that it’s there in the event is still great.

Is Wealthfront FDIC Safeguarded?

Wealthfront Money accounts are FDIC safeguarded up to $1 million. This is equivalent to Improvement and is multiple times what the typical bank gives.

Like Improvement, Wealthfront safeguards their venture accounts with SIPC protection of up to $500,000 per account and $250,000 on cash.

Admittance to Assets

Low expenses and high level portfolio hypothesis is perfect. Yet, absolutely no part of that might matter in the event that you can’t gain admittance to your money when you want it. This is what the withdrawal cycle resembles for the two organizations.

Might You at any point Remove Your Cash From Improvement?

Indeed, you can remove your cash from Advancement and you’ll be charged no expenses to do as such. For withdrawals from cash accounts, Improvement says that you can anticipate that your assets should show up inside 1-2 work days.

For speculation accounts, Improvement gauges that assets ought to show up inside 4-5 work days. You could accept your assets sooner. Yet, assuming Improvement needs to offer a portion of your protections to fulfill the withdrawal, they’ll require time for exchange settlement and ACH handling. Improvement says that at whatever point they sell shares for you, they do it in a way that limits charges.

Likewise, you can decide to move an Improvement IRA to another IRA supplier or basically close your record out and out. Be that as it may, regardless of which choice you pick, you won’t be charged any expenses.

Might You at any point Remove Your Cash From Wealthfront?

Indeed, you can pull out your assets from Wealthfront whenever without any charges. Notwithstanding, Wealthfront draws an everyday ACH withdrawal line of $250,000.

For cash accounts, Wealthfront says that reserves regularly show up inside 1-3 work days. Furthermore, for venture accounts, they give a gauge of 3-4 work days. To forestall tax evasion, Wealthfront puts a 5-day hang on any new stores.

If you have any desire to move a Wealthfront IRA, you’ll have to converse with somebody from their Client Administrations group.

Different Specializations

While there is a ton of cross-over between these organizations, there are a couple of contrasts. We should investigate a couple of the things that put these robo-consultants aside from each other.

Improvement

The following are a couple of items and administrations that are novel to Improvement.

Improvement Monetary Specialists

Improvement empowers you to get live counsel from human monetary guides, who can assist you with any inquiries you have in regards to your speculation exercises.

Monetary Guidance Bundles

As a top notch administration, you can likewise get one-on-one assistance from a monetary master. You can buy a couple of meetings going from 45 to an hour each, under the accompanying plans:

Beginning Bundle – $199

Monetary Exam Bundle – $299

School Arranging Bundle – $299

Marriage Arranging Bundle – $299

Retirement Arranging Bundle – $299

Outside Record Examination

For most financial backers, contributing goes past the prompt portfolio. Advancement has the ability to audit what is going on, including accounts not oversaw by Improvement.

This will provide you with a more all encompassing perspective on your generally speaking monetary circumstance. In any case, this help is accessible just with Advancement Premium (see underneath).

Advancement Premium Arrangement

With a base record total of $100,000, and a yearly warning expense of 0.40%, you get every one of the advantages and administrations of the Computerized plan, in addition to:

Outside Record Examination

Limitless admittance to Advancement’s Guaranteed Monetary Organizers

This plan consolidates the best of the essential robo-counsel administration, with limitless admittance to human monetary consultants.

Beneficent Giving

With this program, Improvement clients with valued offers can give long haul speculations from their available records. Not in the least does accomplishing something beneficial by giving offers assistance you put your cash where your qualities are, however it can likewise assist your duty with troubling.

You are taking out capital increases charge on gave offers and you can deduct the worth of the gift on your expense form. Furthermore, Improvement ensures that their Beneficent Giving system works couple with their other expense methodologies.

To make beneficent giving simple for you, Improvement tracks the amount of your record is qualified to provide for a noble cause, gauges the tax reductions of your gift, moves resources from your record to a magnanimous association’s record with no desk work, and gives you a duty receipt.

Wealthfront

The following are a couple of items and administrations that are special to Wealthfront.

Wealthfront Free Monetary Preparation

Wealthfront free monetary arranging is controlled by programming based guidance motor called “Way.” It conveys monetary arranging devices to assist you with making arrangements for retirement, homeownership, and school financing for your kids at no expense at all.

You can utilize the application to decide the effect of expanded reserve funds or decide how much monetary guide you can expect when your kids go to school.

For lodging, Way permits you to partake in virtual house hunting through Zillow and gives the best systems to put something aside for your initial investment.

Wealthfront Portfolio Credit extension

This element is programmed in the event that you have speculation accounts with Wealthfront adding up to $25,000 or more.

You can get up to 30% of your record worth, and make reimbursements on your own timetable. Also, the credit extension is gotten by your Wealthfront portfolio. That implies there is no application cycle, and no capability in view of credit or pay. Current loan costs are somewhere in the range of 3.9% and 5.15% APR (as of November 2019).

Advancements

Each robo-counselor offers limited time chances to assist you with pursuing your decision more straightforward.

Presently, Improvement is presenting to one year oversaw free of charge. Store up $250,000 or more in the span of 45 days of opening a record, and you will get one-year free administration. Store $100,000 – $249,999 in the span of 45 days, and get a half year free, and store $15,000 – $99,999 for multi month free.

Advancement versus Wealthfront-Which is the Better Robo-consultant?

In truth, not one or the other! More than whatever else, it descends to your own inclination in what you need a robo-counselor to accomplish for you. Assuming you feel that a portfolio blend that underscores esteem stocks is really engaging, Improvement will be your decision. In any case, assuming you favor a portfolio that likewise incorporates expansion touchy venture, similar to land and regular assets, Wealthfront will be the unmistakable victor.

Different contrasts, similar to Wealthfront’s credit extension or 529 records, or Advancement’s admittance to monetary guides or Magnanimous Giving, might be contemplations for your choice.

Concentrate on each robo-counselor and see which will turn out best for you. Yet, they’re both magnificent administrations, and you can’t turn out badly with by the same token.

Do you have insight with both of these organizations? How could you track down them?

4 comments

vurcazkircazpatliycaz.1kWjFkKrCgbR

daktilogibigibi.DwE8SOrdnwyG

daxktilogibigibi.o5yJDhSDmlV8

squeezings xyandanxvurulmus.cUKWrxkkRRyK