Empower: Best for

- Higher-net-worth clients

- Tax-loss harvesting

- Portfolio construction

Previously known as personal Capital, Empower’s contribution is extraordinary among robo counselors and shares all the more practically speaking with conventional monetary consultants in specific regions. As a matter of fact, Engage doesn’t view itself as a robo-counselor, rather alluding to itself as a computerized abundance director. Clients gain admittance to human consultants who will attempt to make portfolios that fit their monetary objectives. You’ll likewise get the advantages of programmed charge misfortune reaping, a component that is not accessible at all robo-counselors. In any case, Engage charges perhaps of the greatest expense in the business that just somewhat diminishes as your portfolio develops. You’ll likewise require at least $100,000 just to get everything rolling. Since the company’s name change, the robo-guide guarantees similar expenses and a continuation of its warning groups.

Empower’s expenses are lower than that of a customary counselor, yet you’ll track down comparable degrees of administration assuming you work with human guides at robos, for example, Schwab Smart Portfolios and Improvement at a fundamentally lower cost.

Empower: In the details

Account Least

$100,000

The board Charge

First $1 million: 0.89 percent; For clients who contribute $1 at least million: First $3 million: 0.79 percent, next $2 million: 0.69 percent, next $5 million: 0.59 percent, more than $10 million: 0.49 percent

Portfolio Blend

Adjustable by client. To exploit charge misfortune reaping, records might hold somewhere in the range of 80 and 120 individual stocks.

Store Cost Proportion

0.08 percent portfolio normal

Account Types

Available independently and together; likewise Roth IRA, ordinary IRA, SEP IRA and rollover IRAs; trusts

Cash The board Record

Essential store account that offers revenue with no record least

Client support

Telephone from Monday-Friday 8:30 a.m. – 6:30 p.m. ET, email

Charge Procedure

Charge adversity harvesting, stock-level mishap assembling and improved asset region

Rebalancing

Indeed

Apparatuses

Complete resources calculator, save supports coordinator, arranging instrument, retirement orchestrating, preparing costs, shared store costs, and some more

Advancement

–empower tools

Enable’s Free Programming

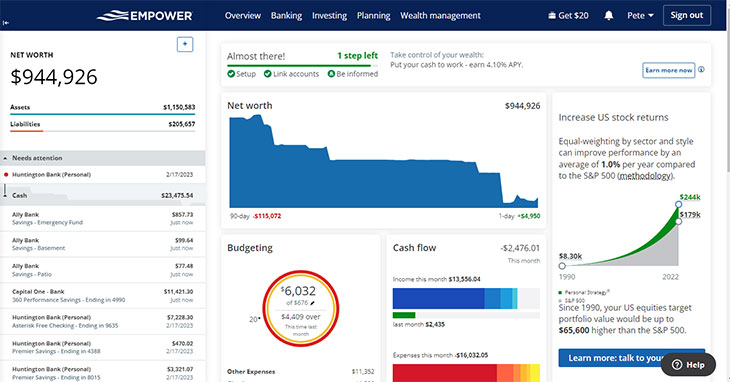

One method for depicting Empower’s free planning programming is as an “account Empower’s .” This program permits you to follow and grasp each penny in your monetary records.

When you connect up the entirety of your different records, Empower’s sums up your funds and offers you essential speculation direction.

This program offers a more extensive (and free!) administration than a comparative contender Mint. The program creates diagrams and graphs to assist you with better figuring out your monetary picture, including the accompanying:

Total assets

Account Adjusts

Pay Reports

Spending Reports

Resource Assignment

Speculation Returns

Projected Speculation Expenses

What are Enable’s without best instruments? We should investigate:

Planning

Fundamental planning is a no brainer with this program. The point of interaction provides you with a comprehension of your spending and record adjusts and permits you to arrange your spending by date, vendor, and kind of cost.

Total assets Following

One of the most incredible elements of Enable is total assets following. Enable empowers you to see your record adjusts, cash, speculations property, credit, home loan, and advances all simultaneously. You can likewise include your home estimation by utilizing the home loan highlight fueled by Zillow.

Empower’s Versatile Application

With this monetary data accessible through Enable’s Free Programming

One method for depicting Empower’s free planning programming is as an “account Empower’s .” This program permits you to follow and grasp each penny in your monetary records.

When you connect up the entirety of your different records, Empower’s sums up your funds and offers you essential speculation direction.

This program offers a more extensive (and free!) administration than a comparative contender Mint. The program creates diagrams and graphs to assist you with better figuring out your monetary picture, including the accompanying:

How to Sign Up for Empower

Click here to head toward Empower it’s allowed to utilize. You’ll begin by making a record by giving your email address, secret phrase, and telephone number.

Click “Join” and you’ve made your record.

It’s as simple as that!

Then, Empower will give you a short survey. You can skip it assuming you’d like.

However, it just requires a couple of moments to finish. Also, it assists their product with looking further into you and your monetary objectives.

Then, you can begin interfacing your bank and venture accounts.

When every one of your records have been added, you can investigate your by and large monetary picture from the Empower Dashboard. You can likewise begin to incorporate your spending plan or plunge into a portion of their high level mini-computers and devices.

1 comment

[…] Empower Review 2023 (previously Personal Capital) […]