Could it be said that you are hoping to deal with your monetary circumstance? empower and Mint both provide you with an outline of your spending and ventures yet in various ways.

Mint is fundamentally an aggregator and planning application, while empower is mostly an aggregator and speculation the board stage yet additionally offers restricted planning capacities.

We should investigate the two administrations exhaustively, so you can conclude who is the champ in Mint versus empower.

What Empower has to Offer

Empower depicts itself as a monetary programming and abundance the board administration. In any case, there’s most likely it’s most popular for the abundance the board side. The help is utilized by almost 2 million individuals, including 18,000 venture clients, with more than $8 billion in resources under administration.

Abundance the board is an exceptional help. Notwithstanding, the monetary programming (the best accessible) is free, and it offers planning and a sound measure of venture administrations.

Free Monetary Programming

Empower planning administration, be that as it may, is moderately restricted.

You can utilize it to follow your income and spending designs, as well as view and break down spending classifications and individual exchanges. It likewise gives month to month synopses, so you can see precisely where your cash is going.

You start by connecting your monetary records to the Empower stage. There, you can total every one of your records in a single spot. They offer a “Income Analyzer” instrument that assists you with making a spending plan.

It does this by following both your pay and costs from your different monetary records. The analyzer likewise helps you put forth and arrive at monetary objectives, such as taking care of obligation or putting something aside for a particular reason, similar to retirement.

Speculation Apparatuses

A major piece of the justification for the notoriety of the free monetary programming Empower offers past planning. Also, that is their venture the board devices. The help merits having for these by themselves.

They include:

Venture Test

Whenever you’ve entered all your monetary records onto the Empower stage, it will survey the dangers and open doors in your different records. Empower will create ideas on how you can streamline those records.

This can work on the exhibition of your venture accounts, even with next to no immediate administration from Empower.

Individual Guide

For a free help, this is an extraordinary advantage. You can contact an individual consultant for questions you have or for more detail on the suggestions made by Empower.

Retirement Organizer

Utilizing a progression of “consider the possibility that” situations, you can add various factors to decide the result of different speculation systems used to arrive at your retirement objectives.

It can assist you with learning in the event that you have sufficient cash put something aside for retirement or need to up your game. It could in fact give projected future retirement portfolio values to provide you with a brief look at what was to come in view of current procedures.

401(k) Analyzer

This apparatus breaks down your 401(k) plan and shows you the charges you’re paying for your record, as well as the speculations remembered for your arrangement.

It makes portion ideas for your arrangement and furthermore gives you cheaper elective subsidizes inside the record. This is significant on the grounds that little distinctions in venture expenses can have a major effect over the long haul.

Abundance The executives

Abundance The executives administrations are essential for Empower superior rendition, yet you additionally approach the administrations and devices of the free monetary programming.

The Abundance The board administration is greater venture explicit and can straightforwardly deal with your records.

While Empower Abundance The executives is frequently mistaken for a robo-guide administration, it works out in a good way past regular robo-counsel administrations.

For instance, it deals with the records straightforwardly took care of by the help, and goes about as a monetary aggregator. That implies it will work non-oversaw accounts into your generally monetary arrangement.

For instance, while they will not straightforwardly deal with your 401(k) plan, they will construct resource allotments mirroring those held inside that arrangement.

Empower Abundance The board requires at least $200,000 under direct administration. Similar as a robo-counselor, they initially decide your gamble resilience, venture objectives, and individual inclinations. With that data, they plan a venture portfolio in light of current portfolio hypothesis.

Your portfolio is put resources into trade exchanged record finances that put resources into US and worldwide stocks and bonds, as well as products.

Notwithstanding, the US values designation is contained up to 70 individual stocks rather than ETFs. What’s more, they utilize strategic weighting with US values.

This system has been beating the S&P 500 by over 1.5% yearly, giving you the potential for more significant yields. They significantly offer a socially mindful money management (SRI) choice.

Other Abundance The executives Administrations

They’ll give the typical venture the executives administrations you get with robo-guides.

This incorporates:

intermittent rebalancing

programmed profit reinvesting

charge misfortune reaping

Charge misfortune reaping is a procedure wherein losing positions are offered to balance acquires in different resources.

Not long after those positions are offered, they’re supplanted with comparable venture assets to keep up with the objective resource distribution for your portfolio.

The methodology attempts to bring down your drawn out capital increases charge obligation, furnishing you with a type of secondary passage charge deferral on available speculation accounts.

Another duty minimization system they use is charge assignment. Pay creating resources (premium and profit producing speculations) are held in charge protected accounts.

In any case, resources that produce capital additions are held in available records, where they can exploit better long haul capital increases charge rates.

Expenses for Empower Abundance The board are as per the following:

Up to $1 million, 0.89% each year.

First $3 million, 0.79%

Next $2 million, 0.69%

Next $5 million, 0.59%

More than $10 million, 0.49%

For portfolios more than $1 million, Enable likewise offers its Confidential Client Gathering that gives customized speculation administrations and abundance arranging, including direct admittance to an ensured monetary organizer.

Here is our full Empower survey if you have any desire to find out more.

Or on the other hand, assuming that you’re prepared to give a shot Enable free of charge, utilize this connect to join.

What Mint brings to The table

As referenced before, Mint is basically a planning administration. And keeping in mind that it has a couple of different administrations that Empower doesn’t, its speculation administrations are really thin.

Mint is an individual planning stage, and it’s allowed to utilize. Similar as other internet based aggregators, it permits you to bring all your monetary records onto the stage to provide you with a more comprehensive perspective on your monetary circumstance.

When you pursue the assistance, you can interface your financial balances, ventures, Mastercards, advance records, retirement plans, and, surprisingly, your PayPal account.

Planning

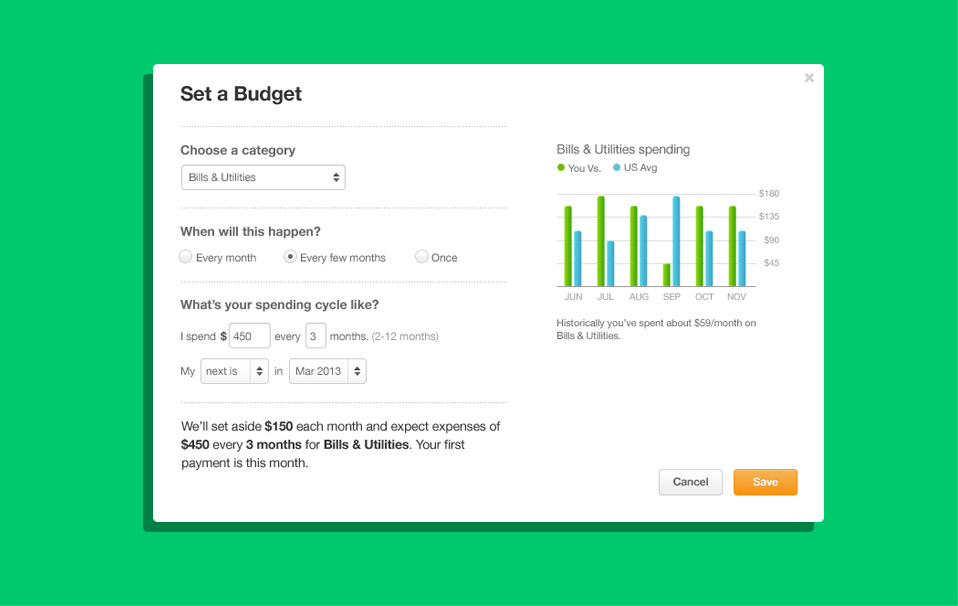

As a planning application, Mint is quite possibly of the most well known stage available. It permits you to make financial plans and track ventures: to track down better approaches to track down reserve funds in your spending plan.

To make the application significantly simpler to utilize, Mint can adjust with practically every US monetary foundation with a Web association.

The application consequently refreshes and sorts your data. Simultaneously, they break down your records, then, at that point, make proposals to assist you with setting aside cash in light of your way of life and objectives.

It is like empower 401(k) Analyzer, then again, actually it goes past 401(k) designs and incorporates financial balances, money market funds, Discs, and IRA accounts.

The application will caution you of impending bills, so you won’t miss an installment and cause a late expense or credit wrongdoing.

You can likewise set explicit cautions, including tokens of bills, when ledgers are getting coming up short on reserves, or on the other hand assuming there are any huge or dubious exchanges in your spending.

You’ll likewise get alerts while you’re surpassing pre-set spending limits in your financial plan, as well as reports on the amount you’re spending on ATM expenses. Both can permit you to amend your spending designs, remain on financial plan, and set aside cash.

Mint Bill Pay and Objectives

Mint Bill Pay

One significant negative with Mint is that they wiped out their bill pay capability as of June 2018. That is a major, expanding opening in an application planned principally as planning programming.

The application keeps on doing everything expected to prepare you to take care of your bills. Yet, you should now make genuine installments through your financial balance or charge cards, as opposed to as a programmed highlight inside the application.

Objectives

Objective setting is one of the more grounded elements of Mint and is one of the better motivations to utilize the application. You can set up and follow progress toward explicit objectives, such as escaping obligation, putting something aside for retirement, or setting aside the up front installment on a vehicle or a house.

You connect an objective to a record, and it then, at that point, appears in your financial plan as a spending classification. Likewise, you can set a particular measure of your spending plan to designate toward an objective and even make various objectives.

It’s a phenomenal component assuming that you’ve been experiencing difficulty setting aside cash for explicit purposes.

Credit Observing

Credit observing is a particular help not presented by Enable and underscores Mint’s focus on the client’s prompt monetary circumstance. The assistance is given through TransUnion and is allowed to utilize.

It gives refreshed FICO ratings as well as makes sense of the variables that make up your score. Comparably significant, it will likewise assist you with further developing your score going ahead.

Also, in the event that that isn’t sufficient, you can set up alarms to advise you any time new data shows up on your credit report. That can assist you with managing mistakes when they occur and know about potential wholesale fraud continuously.

As is normal of veritable free FICO rating suppliers, Mint doesn’t need that you “put a Visa on document” to get to the help. (This is indicative of “free” FICO rating suppliers that give you free admittance to your score temporarily, then start charging you on the off chance that you don’t explicitly quit the assistance.)

Speculation Instruments

Mint offers a couple of free devices to assist you with better dealing with your ventures, however it’s anything but an exhaustive speculation the executives application, nor does it attempt to be.

Furthermore, dissimilar to Empower, there’s no choice for an exceptional direct speculation the board administration. In any case, the venture devices offered are useful for a new or little financial backer.

Mint tracks and sums up your speculations, which can give you a more clear image of what you have and where it’s contributed.

They likewise give a free examination that will feature the charges you’re paying-and might be covered up in your speculation proclamations. That incorporates essential record expenses, exchange charges, and, surprisingly, 401(k) charges.

Is Mint Truly Free?

Yet again mint is allowed to utilize. Be that as it may, similar to Credit Karma and other free administrations, they can offer the help for nothing since they make proposals of different specialist co-ops.

These incorporate charge card offers, checking and investment account, speculation accounts, IRAs, insurance agency, and loaning sources. Mint gets a commission on the off chance that you pursue any of these administrations, permitting them to keep the application free.

Here is our full Mint audit assuming that you might want to find out more.

Empower versus Mint: Which Will Turn out Best for You?

In the event that you’re searching for a free planning application, Mint is the better decision of the two. Planning is Mint’s essential mission, and it’s very great at it as free programming administrations go.

Notwithstanding, the end of the Bill Pay highlight decreases its worth fairly, despite the fact that it’s as yet worth having for fundamental planning and following purposes.

Mint Objectives is certainly worth experiencing in the event that you’ve experienced issues setting aside cash in the past since it can transform saving into an ordinary financial plan thing.

Assuming you’re basically inspired by speculation highlights, Enable is the better decision. Indeed, even the free rendition gives important financial planning devices that can assist you with dealing with your speculations all alone.

However, if you conclude you need to give that occupation to the experts, you have the choice of exchanging up to Empower Abundance The board.

Assuming your fundamental interest is planning, Mint is the better decision. However, in the event that it’s effective money management, Enable wins without any problem.

Do you utilize both of these administrations? How has your experience been?